US employees score the highest globally in a new Financial Wellness Index by nudge, a financial education platform.

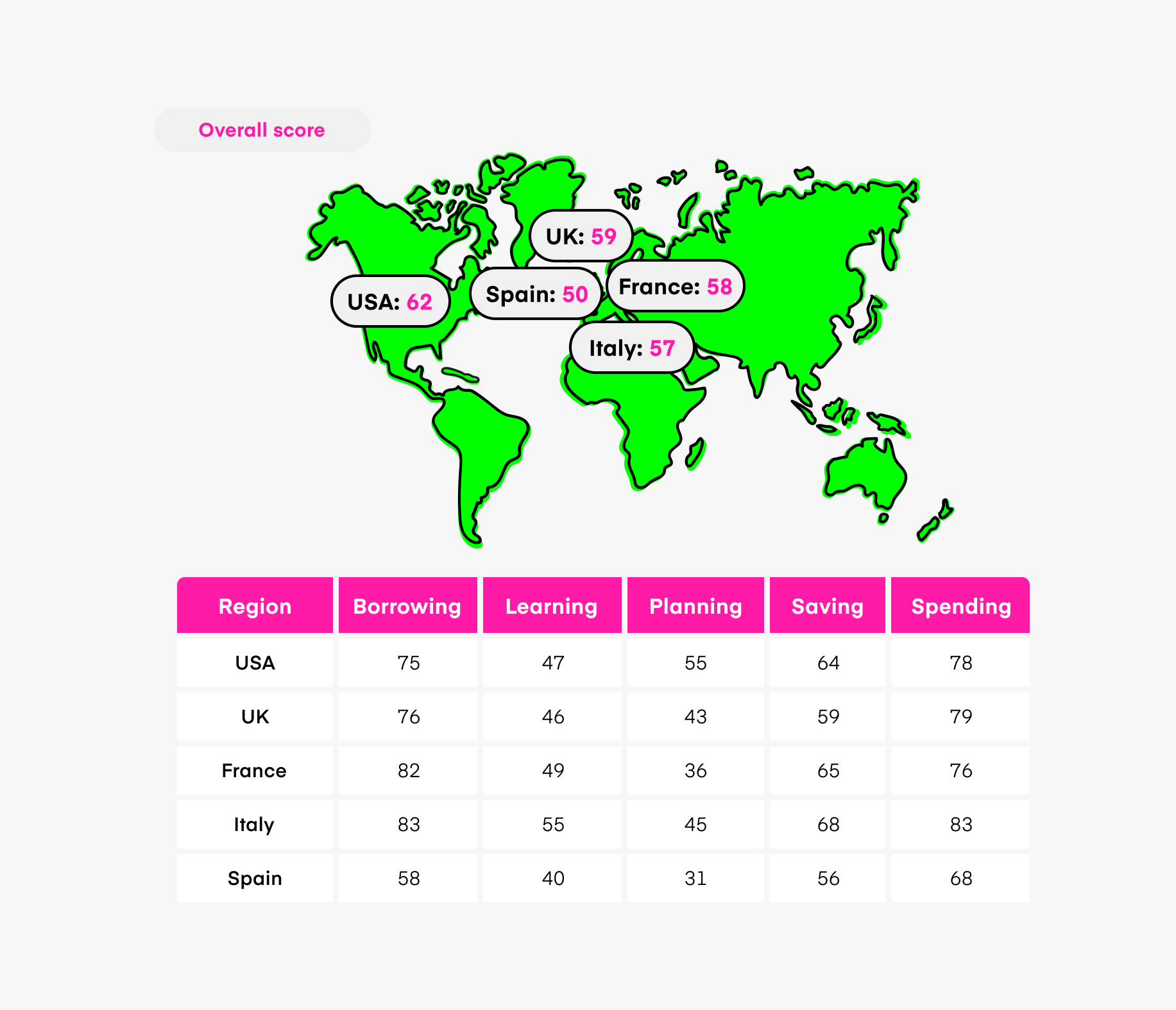

Having analysed data from over 20,000 global employees, nudge has revealed that the United States has a higher overall financial health score of 62/100 and an average financial saving score of 64/100, which is 10 points higher than the global average saving score (54/100).

According to data from AWS, for employees, finances are the number-one source of stress at all income levels. 52% of employees with an annual household income of $100,000 or more report feeling “stressed by finances.”

Commenting on the findings, Tim Perkins, nudge co-founder and CEO said: “Because employees in the US need to be more tactical with their money compared to other countries, as there are fewer ‘social safety nets’ available, they are also more proactive with their finances. 65% of adults in the US invest in stocks and shares, reflecting a proactive approach toward securing their future and eventual retirement.”

The UK has a lower overall financial health score of 59/100. Similar scores are reflected in Southern European countries’ data, highlighting a common theme. For example, France has an average overall health score of 58/100 and Spain has an overall health score of 50/100.

Perkins added, “the surge of inflation and cost-of-living has European millennials struggling. Their commitments made on historically low interest rates have now increased, making it harder for them to budget on higher repayments. This may indicate their lower overall financial health score”.

A report from Greystone Consulting, a division of Morgan Stanley, concluded that 49% of employees who are distracted from financial stress “spend three or more working hours each week thinking about or dealing with issues related to their personal finances. Over the course of a year, a full-time employee may spend more than 156 hours (or 19.5 days) distracted from work because of personal money matters.”