Analysis reveals the poorest Londoners have seen almost no benefit from the introduction of the National Living Wage. Low-paid workers in the capital saw their wages grow at the slowest rate in Britain, while their living costs rose at the fastest rate. “Double bind” puts the poorest Londoners at higher risk from surging inflation than anyone else in Britain – analysis from the world’s biggest job site Indeed.

For London’s lowest-paid workers, it was the worst of times, it was the worst of times. One year on from the introduction of the National Living Wage, official data shows the capital’s low earners are seeing their wages grow more slowly than anywhere else in Britain, while their living costs are rising faster than anywhere else. The National Living Wage – which was introduced in April 2016 to boost the pay of Britain’s poorest workers – has had minimal effect on the standard of living for low-paid Londoners, according to new analysis by the world’s biggest jobs site, Indeed.

In the 12 months before the National Living Wage came into force (the last year for which official data at the regional level is available), average salaries for the poorest 10 percent of Londoners rose by just 5.1 percent in nominal terms – the slowest rate in Britain. Yet researchers found that at the same time, the cost of living in London rose faster than anywhere else. Average rents in the capital rocketed by 3.7 percent – 10 times faster than in Wales and seven times faster than rents in Scotland.

Table: London rents rise faster than anywhere else in Britain

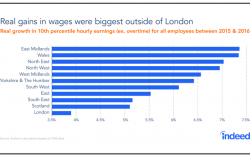

When the cost of non-housing related inflation was factored in, the analysis revealed that real wages for low paid-Londoners rose by only 3.9 percent during the year – far behind the second worst performing area, Scotland.

Table: Low-paid Londoners endure Britain’s slowest rate of real wage growth

The introduction of the National Living Wage compelled few London employers to increase the salaries of their lowest-paid staff. When the law came into force in April 2016, the poorest 10 percent of Londoners were already earning on average five percent more per hour than the £7.20 minimum initially stipulated by the National Living Wage. As a result the picture painted for London’s lowest earners is grim – they were already seeing the slowest real wage growth in Britain when the National Living Wage was introduced, and one year on, the new law will have made minimal impact on their paypackets.

Mariano Mamertino, EMEA economist at Indeed, comments: “Low paid Londoners are in a double bind. Their earnings are typically too high to have been increased by the introduction of the National Living Wage – yet their living costs are both the highest, and the fastest rising, in the country. The National Living Wage is a national minimum. This means it disproportionately benefits regions where wages and living costs are lower, and does little to help Londoners whose earnings and rental costs are higher. London’s poorest workers already had the slowest rate of real wage growth in Britain when the National Living Wage was introduced. With few Londoners seeing any benefit from the introduction of the new minimum pay level, many will be sitting ducks as rising inflation erodes their real earnings still further.”