The Digital Age has been revolutionary in a number of ways to such an extent that the word ‘Disruption’ has come to signify the kind of transformative change that uproots existing norms of competitive economies and forges a path of its own by rewriting the ‘rule book’ while relegating the complacent titans of industry to the annals of history. It’s the kind of trailblazing that is majestic in nature and game-changing in practice. However, organizations that are built upon such innovations are also highly susceptible to becoming like the ones they replaced as the challenges of exponential growth come into focus, especially, after the ‘aura’ of being a ‘startup’ disappears. An interesting feature of the Digital revolution is that the startups are thinking ‘Big (expansion-focused)’, while, the conglomerates are thinking ‘Small (streamlining-focused)’ in their quest for relevance and competitiveness.

Additionally, preserving/sustaining/promoting a strong organizational brand has become critical for leadership in the Digital Age as ‘pristine’ reputations are increasingly susceptible to significant, and quite often, irreparable damage from a few keystrokes of an internet-savvy disturbed/disgruntled/disillusioned party from any corner of the world.

Furthermore, gaining a degree is no longer considered ‘essential’ for success in an era where ‘abandonment’ has become ‘fashionable’ due to the ‘glaring’ achievements of ‘dropouts’, who continue to receive ‘rock star’ status in the startup world. This is being reinforced by the huge influx of MOOCs (Massive Open Online Courses) and core emphasis on specific skills, rather than, broad academic credentials. Consequently, the professionals of today have to maintain the momentum to ‘outdo’ themselves by timely replenishing hybrid skills through honest introspection, keen sense of dynamics in the relevant ecosystem, brazen propensity for self-improvement, and timely pivoting to growth opportunities to increase the value of their indispensability for discerning employers.

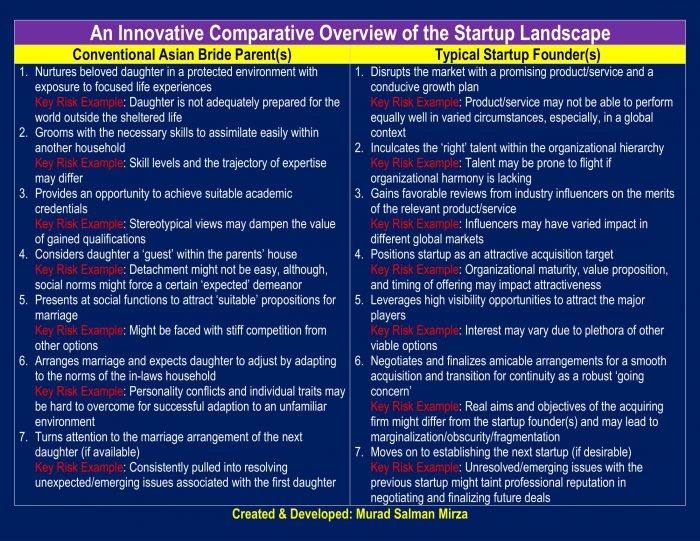

A key troubling factor in the surge of startups vying for IPOs (Initial Public Offerings) with inflated evaluations is the proliferation of half-baked organizations propped up as emblems of fruitful innovation in the Digital Age. This has been exacerbated by the increasing trend of ‘serial entrepreneurs’ who are routinely fêted for founding multiple startups to subsequently dispose at the ‘right’ price. However, such initiatives keep on adding to the glut of corporate entities that lack the maturity to survive beyond the ‘hype’ stage and contribute to ramping up failure rates at an alarming rate. Let’s explore this phenomenon through the following analogy:

The aforementioned comparison provides a vivid picture of the inherent fragility of startups that are being paraded in front of opportunistic investors to gamble on the promise of healthy ROIs (Return on Investments). It is important to realize that organizations have business lifecycles and technological innovations alone cannot be a harbinger of success. This is borne out by the fact that incomplete/immature service models are becoming an increasing cause of concern for demanding customers/clients of profoundly tech-savvy companies, especially, those heavily reliant on AI-enabled platforms/entities, due to their frequent shortcomings/failures in adapting to multi-dimensional/unforeseen service conditions, e.g., courier firms are generally highly proficient/competitive in ‘product delivery’, however, lag significantly in appreciably/consistently upholding any outstanding standards with respect to ‘product return’, ‘product replacement’ and/or ‘product recall’.

The following questions can be used in the form of a checklist to review the soundness of a startup entity as a business before taking any investment decisions:

1. Who is the top/senior management? What is their professional background? Do they have a clear vision and profound sense of purpose? Are they futurists?

2. What are the organization’s strategic objectives/expansion plans for the future and the projected/expected growth rate? How much success have they already achieved? Have they successfully overcome any major challenges along the way?

3. How do their key customers feel about the quality/reliability/good points/bad points of their products/services?

4. What is the breakeven time frame for the investment and the projected ROI?

5. Who are their bankers/creditors and have they had any problems with them?

6. Who are their major competitors and how do their products/services rank against them?

7. How often do they have to upgrade/maintain their equipment/machines?

8. Can their equipment/machines be hacked? How are they safeguarding/protecting themselves against hackers?

9. Are they significantly susceptible to obsolescence by a competitive technology that uses cutting-edge knowledge, e.g., Machine Learning, Deep Learning, Neural Networks, etc.?

10. Do they have any consumer surveys/feedback available to see how effective/delightful/user-friendly are their products/services?

11. Can their equipment/machines still function without online connectivity? If not, what safeguards/redundancies have they undertaken to ensure uninterrupted availability of products/services?

12. Is your investment comprehensively protected from any lawsuits that a client and/or a consumer may instigate in case of any product/service failures?

13. Is there a Board structure in this organization? If so, what is the caliber of Board Members? Are they largely ceremonious or do they add ‘real’ value to the effective functioning of the organization? Is a Board position with voting rights offered as a result of the investment?

14. Are financial statements/records available for review? What is the major drain on their resources? What are the key boosters? How good is their health as a ‘going concern’?

15. What kind of freedoms/legal remedies do you have to withdraw the investment if things don’t go well according to expectations?

16. Do they hold patents for their technology/products/services? If so, how much time is left on their patents before others can use the same technology and/or replicate their products/services?

17. Have there been any HR/labor issues in their organization? If so, what kind and how effectively have they been handled?

18. How good is their relationship with their suppliers/subcontractors? Have there been any issues? Are they overly dependent on any key supplier/subcontractor?

19. Are they in total compliance with relevant regulatory guidelines/rules? Is there a monitoring frequency, e.g., monthly/quarterly/yearly visit from the relevant agency/agencies? What are the penalties for noncompliance?

20. Do they have partnership agreements with any other organizations in terms of patent technology, computer hardware, systems support, specialized equipment, industry research, etc.? If so, what are the key aspects of those agreements?

21. Has due-diligence been done on them, e.g., by an independent audit firm? If so, what were their latest findings?

The aforementioned questions are designed to provide insights into the risks and rewards associated with investing in a seemingly-lucrative startup. Additionally, it provides the basis for framing a strong business case to placate the concerns of key stakeholders associated with the prospective investor who might be jittery due to the excessive hype around the startup of interest buoyed by vested interests.

Parting Thoughts

The average life of organizations used to be 60 years in the 1950s; it is less than 20 years in the Digital Age. This presents tremendous challenges and wonderful opportunities for innovation. Whether an organization listens to the ‘Prophets of Doom’ or the ‘Prophets of Nirvana’, the key to staying relevant and competitive in the Digital Age is to keep evolving under a capable and astute leadership with integrity, foresight, and in a disciplined way that also boosts confidence of prospective investors. Are you prepared accordingly?