As the industry has witnessed the exponential rise in the number of contractors working via umbrella firms since the introduction of the new IR335 legislation earlier in the year, we have also seen a proliferation of disguised remuneration schemes. That rise has meant that many contractors may have been hoodwinked into signing up for tax avoidance schemes that could have a significant impact on their finances in time.

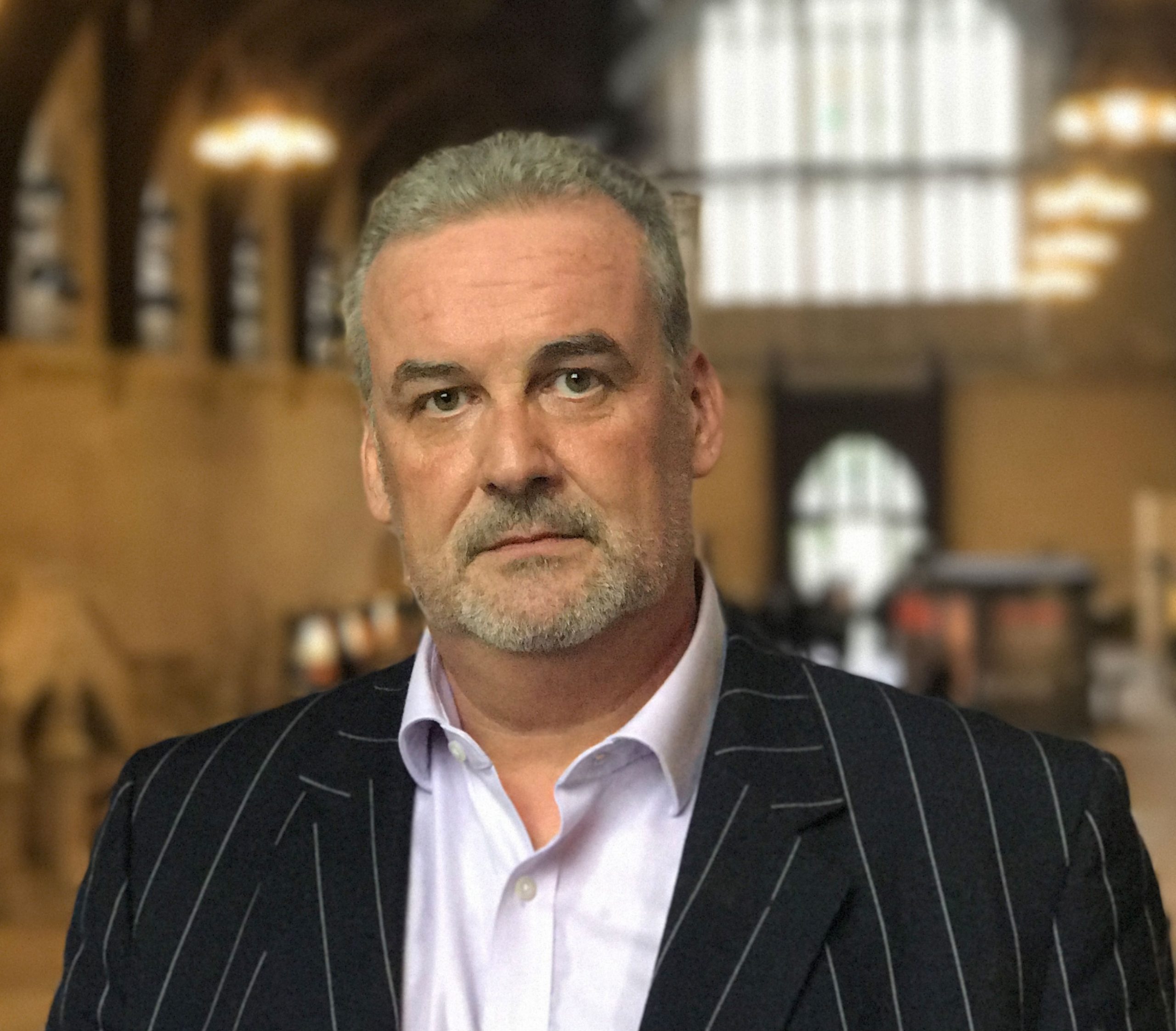

Crawford Temple is CEO of Professional Passport and he is urging HMRC to focus on the promoters of the schemes rather than the workers. HMRC is simply not stamping down on the schemes concertedly enough and persists in chasing the victims of the schemes, lately issuing tax avoidance warning letters to workers suggesting they may be caught up in a disguised remuneration or tax avoidance scheme. In some ways, this is good news, as it serves to alert workers. However, it is simply the wrong strategy and works to incentivise the promoters of such arrangements and allows them to thrive.

The latest letter issued by HMRC to workers states:

We take action to challenge those who promote tax avoidance arrangements. However, you’re responsible for making sure your own tax affairs are correct.

The letter goes on to say:

Your employer should make sure the right amounts of tax and NICs are paid to us for your earnings. However, in some circumstances you may end up being responsible in law for paying them…

The letter clearly suggests that the liability lies with the workers and is designed to cause concern to the recipient in the hope they will act and leave the scheme if they are caught up in one. Obviously, if a worker is in a scheme, then yes, they should leave this as quickly as possible.

The letter begs the question – could there be a more cynical reason behind these letters?

Whilst there is a principle within UK tax law that an individual is responsible for their own tax affairs, this is overridden where they are employed by a UK employer who operates PAYE on the income. HMRC can challenge this overriding principle where they can show that the employee was aware of the arrangements. So, are these Tax Avoidance Warning letters simply a way for HMRC to shore up an argument to recover unpaid taxes from an employee by stating that they were informed and therefore must have been aware?

Has HMRC been buoyed by its actions against those workers involved in loan arrangements and feel this is by far the simplest and most cost-effective way to seek recovery? The workers are a soft target and are unlikely to have the resources or ability to fight the claims.

If, as the letter states, ‘we believe they may have become involved in tax avoidance’ then the logical question is what action has HMRC taken against the employer? Surely, HMRC must hold significant data to justify writing to a worker and so, it would be reasonable to assume that HMRC has also used some, or all, of its other powers against the suspected provider to protect its position – but that’s not what is happening. We know of workers who have received these letters and yet still the providers are blatantly operating in the market with no visible action taken against them.

So why isn’t HMRC opening enquiries on these companies at the same time as issuing letters to workers?

And why isn’t HMRC using its powers under security notices to secure funds from the companies to protect its position on under paid taxes?

It would also be reasonable to assume that as HMRC can also identify any recruitment company engaging workers through these dodgy companies HMRC would have also written to recruiters as well.

How should the recovery of unpaid taxes work?

In the first instance HMRC should seek recovery from the employer. The vast majority of disguised remuneration schemes fail to operate PAYE correctly on a worker’s earnings and attach a wide array of nonsensical labels to the untaxed amounts. The fact that the employer has failed to operate PAYE correctly means that in all cases HMRC should use its powers to seek recovery of the underpayment from the employer.

HMRC should also be able to protect its position by issuing security notices asking a company to lodge funds with HMRC to protect the potential losses identified through the disguised remuneration scheme. Failure to comply with these notices would stop a provider from trading.

Where an employer fails to pay a liability, HMRC also has the powers to transfer the liability to the directors of the company as a personal liability and should then take all the necessary steps to recover the money from their personal assets.

If they are still unable to recover the liability, and where an agency has been involved, then they could seek to recover the monies from the agency as not all the income has been applied as employment income and so the conditions in the legislation are not met. This means that in certain cases this liability could be passed back to the recruitment company.

Only after all these steps have been taken should they seek recovery from an individual and only where they can show that the individual was aware of the arrangements.

New Legislation

Over the years, a catalogue of legislation has led to a series of unintended consequences that has not served to help and support the contingent workforce and the wider supply chain for the better, yet HMRC is persisting on introducing more new legislation to add further layers of powers. Why?

If HMRC is not already using the vast array of powers it currently has, the introduction of more legislation built around further powers will make little difference for the better. A cynic might suggest that the move is simply one to provide ministers with convenient soundbites so that they can appear to be taking tough action on tax avoidance and disguised remuneration.

It is difficult to come up with any conclusion that sits positively with HMRC or Government.

All we know for certain is that we are seeing high levels of disguised remuneration in the market with common names emerging in many of the operations. This is reaching levels of an industrial scale and despite the information available in the public domain that would identify the perpetrators of these corrupt schemes HMRC is still slow to act.

It does beg the question as to whether the Government and HMRC are serious about addressing tax avoidance and disguised remuneration or whether any of the growing number of conspiracy theories could actually hold some truth? Questions need to be asked and the Government and HMRC needs to be held accountable as a matter of urgency.